thetut

-

Posts

92 -

Joined

-

Last visited

-

Days Won

1

Posts posted by thetut

-

-

Click on "Interview Setup" in the left panel

In the right panel look for "Employment and other benefits" box

Click on the box at "GST or HST rebate ,,,,,,,,,,"

Click on the blue horizontal arrow and select the appropriate page from the pop up

-

Click on "? help" in the top right

Click on "Open Help" in the box that opens up

Click on the "+" beside "Software Training" In the left hand pane

Click on "How to videos"

Click on "How to claim the Digital News Subscription tax credit (DNSTC"

Enjoy the video

-

-

You're welcome.

-

Are you sure you entered the decimal point between the 4 and the 6?

-

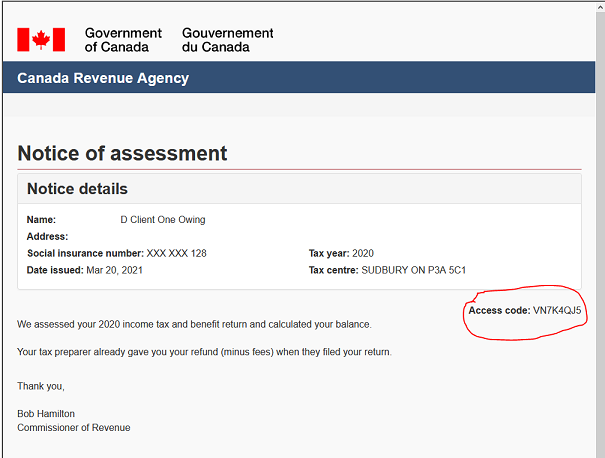

Top right hand side of your last Notice of Assessment.

-

Select "4 Tax Return"

Select "Print" near the bottom of the page.

In the window that opens select "Selected pages" and follow the instructions just below it.

-

Did you answer "Yes" to the question "Did this dependant have any income in 2021"

You will find it in her file on the Dependant ID page.

-

You're welcome.

-

Have you tried logging on to your CRA and/or your RQ account to verify the telephone number listed in same?

-

-

-

-

-

In the left column, press the Negative sign for any entry you want to erase.

-

1618 is a Windows error code that means: "Another installation is already in progress. Complete that installation before proceeding with this install."

-

-

According to CRA website you should be able to AutoFill for this year and the 4 previous years.

I just tried it on 2019 and it worked.

-

-

From the help file:

Your province of residence is not Quebec and you were employed in Quebec

In the navigator, select T4 and employment income > T4 income earned in Quebec. (This options appears only if your province of residence is not Quebec.)

If you worked in Quebec, your employer should have given you both a T4 slip and a Quebec RL-1 slip. The RL-1 slip should indicate your contributions to the Quebec Pension Plan (QPP) and your Quebec income tax withheld.

Copy the amounts from your T4 and RL-1 slips as requested on the T4 data entry form. The T4 data entry page you use for these slips must show a field for entering QPP. (If it shows CPP (Canada Pension Plan), you are using the wrong T4 data entry page or you entered the wrong province of residence at the Identification stage.) The program will automatically calculate the amount to transfer from the MRQ to the CRA.

You will find an entry box for Box J on this page.

-

-

If you’re temporarily living outside of Canada, you can file your return using NETFILE as long as you still have residential ties in Canada and maintain a Canadian address.

Don't forget that you will need the access code from your last Notice of Assessment to Netfile. It is an 8 digit code located in the top right of the document.

-

Check your OneDrive folder for *.u20 files.

I seem to remember the auto save for u20 was to the cloud OneDrive.

-

Sign in to your CRA account and use the "Change my Return" function located on the "Overview" page in the "Tax Returns" box.

Read the "Change my Return" instructions.

Hope this helps.

Quebec Line 462 - independent living credit for seniors - Where to input this in the Interview section in UFILE?

in Credits and deductions

Posted

In the box "Quebec line 462" that you show, click on the ? at TP-1029.SA and it will explain what to do.